Latest

Change is Now: Peak in a Pandemic Webinar Recap

As the retail world continues to be rocked by the global pandemic, it is more important than ever that businesses and brands look to insights and partners to help guide them through this challenging time.

At Summit we have launched the Change is Now webinar series, to share our own valuable insights and to invite industry experts to share the knowledge and data that is informing their and their clients’ decision making. You can sign up to the full series here.

Kicking off with the first in the series ‘Peak in a pandemic’ – our Managing Director, Martin Corcoran was joined by Lisa Hooker and Jacqueline Windsor, both Partners at PwC, and Mona Nikzad, Digital & E-commerce Strategist at Organix.

Starting by sharing some of the insights that Summit are currently using to drive the decisions and tactics being employed to help our retail clients grow at this time, Martin shared a number of statistics that are helping to inform long-term strategies, including:

- Google’s share of ad spend is down 34% since 2016

- Share of sales attributed to social channels is doubling every year – now worth 10% of sales

- Channels managed in combination deliver 35% more sales than channels managed in isolation

However, in the short-term, by using our Marketing Intelligence Platform Forecaster, we have been able to understand the historical changes in customer demand and predict what will happen over the next few months.

And when it comes to customer behaviour, we are seeing a huge increase in demand for e-commerce – with a minimum increase of 30% in customers shopping online, resulting in a much bigger and longer peak online.

Finally, following a survey Summit carried out across 500 consumers, we discovered the following:

- 36% of customers who shopped exclusively in-store last year, will now shop online

- More than 50% of customers started their Christmas shopping before October, up 20% year-on-year

- 65% of customers have the same or more budget than last year

Martin then closed with his four top tips for peak:

- Plan for 50% growth in e-commerce through peak

- Use breadth of digital marketing and sales channels in combination

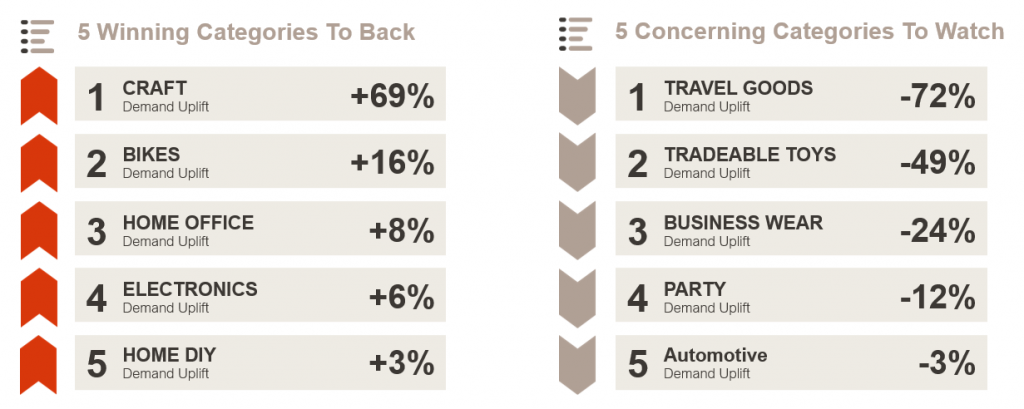

- Hero products with sustained behavioural change such as craft, bikes, and home office

- Go early. Go NOW in driving sales

Consumer behaviour and sentiment

Handing over to Lisa and Jacqueline from PwC, Lisa began by giving an overview of consumer sentiment. Having dropped heavily in March when lockdown was instigated, she said that consumer confidence had actually returned to just below the post-election levels – a huge improvement on what we saw from the last financial crisis. And even more importantly, this improvement is across every age group and region.

However, Lisa pointed out that although there was consumer confidence, there was also data to show that consumers are shifting their spending priorities. Noting customer behaviour that stuck following the last global financial crisis and subsequent recession, consumers embraced shopping at discount chains – a trend that remained.

Following the pandemic, PwC predict that the sorts of behaviour that will stick will include buying from brands that do the right thing by their customers and staff, as well as people purchasing from smaller and independent shops.

Handing over to Jacqueline, we then heard that the other development that will really shape consumer markets will be the level and pace of digital disruption – which is influencing every consumer vertical that PwC touch. This leads to one clear implication – consumer expectations are rising across any brands and retailers they interact with.

Emerging business models

Showing evidence for a number of emerging business models entering the consumer repertoire, Jacqueline outlined two responses to this development – one is around convergence, and the second is around partnerships.

Looking at convergence, Jacqueline showed some examples of how incumbents are responding to current trends. Using ASOS as the first example – going from a retailer of third-party brands to then expanding their own range, they have more recently launched two marketplace models – one for boutique and independent brands, and second on resale.

Another example Jacqueline shared was Farfetch. Launching as a marketplace platform for independent boutiques, it has made a number of acquisitions of different business models – whether it is a resale platform like Stadium Goods, or actually brands themselves with the acquisition of New Guards Group, who owns brands like Off-White. And then finally, there is also a convergence of B2C and B2B – YOOKX being a great example, with a customer fascia as well as providing B2B offerings and white label e-commerce websites for smaller, luxury brands.

Making the most of partnerships

Looking at the second response, covering partnerships across the end-to-end value chain, Jacqueline pointed to some interesting partnerships happening across the retail space. Highlighting Adidas and the partnerships they are making with brands that capitalise on consumer trends, she noted the importance of partnerships that also aid things like logistics – sighting Deliveroo as an example, having partnered with discounters and grocers.

How to win with digital

Wrapping up, Jacqueline highlighted three big key success factors to winning on the digital channel:

- Driving customer lifetime value

- Winning in social

- Getting a really optimised user experience online

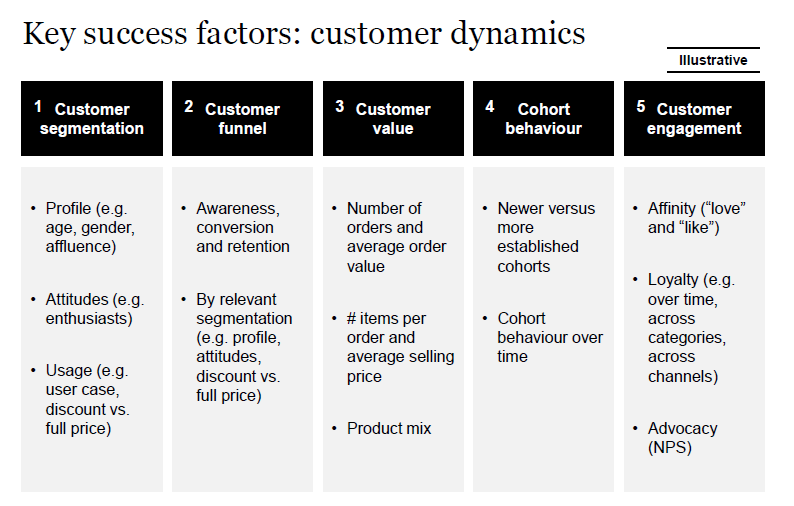

So, for customer dynamics, the key things to get right include:

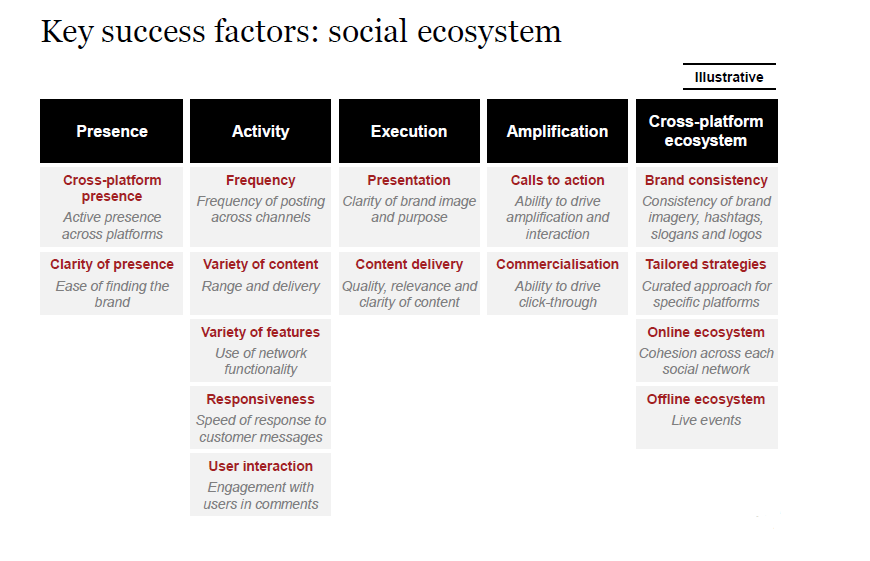

And for winning in the social arena:

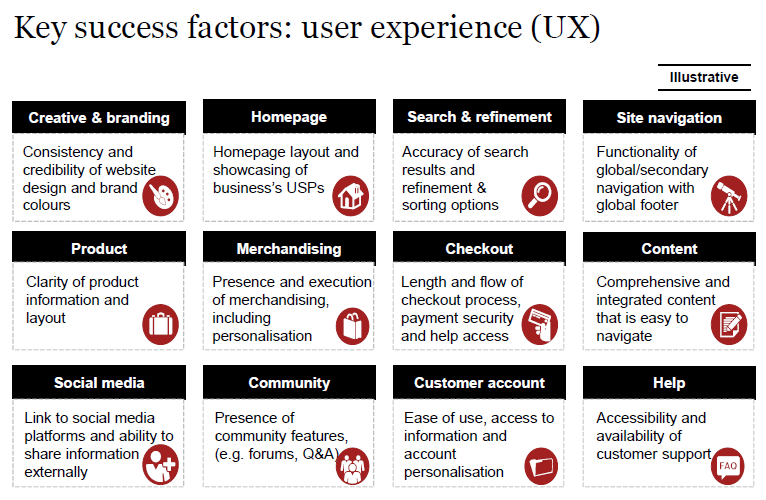

And finally, user experience:

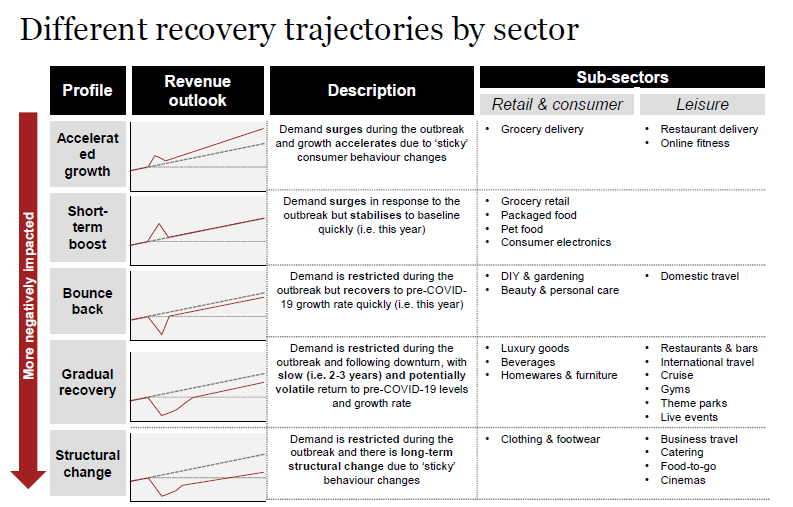

Finishing by looking forward, Jacqueline admitted it wasn’t an easy place to trade right now, with a lot of pressure on consumer wallets. She showed the 5 different recovery trajectories that PwC had identified:

A prediction for peak

In summary, Lisa outlined what she thought would happen for peak this year and the important things for retailers to be aware of. Starting on a positive, she reminded us that consumer confidence is strong and that retail sales are above last year from June. However, she did point out that economists are telling her that their latest forecast is a drop by about 3-6%. So, whilst online is definitely going to win out, there is a decline on the way.

Speaking about Black Friday, Lisa told us that the fact it is late in the month like last year means that it will have a similar impact and encroach on Christmas trading like it did in 2019. Also, people are planning more; being at home means they have the time to, and it is also helping them spread the cost.

She mentioned the 5 Cs that are going to play a part. Channel and Convenience have been important for years, but Curation is going to play a big part in the way people shop during peak. Helping people to curate and making it easy for them to shop is going to be key for brands to drive sales. Communication will be important, and it is important for brands to communicate to customers not about where they were last year, but where they are today. And Credit is really coming to a forefront – so it is important to think about how you can bring credit into your offering.

Finally, what will this mean for January? Lisa advised managing stock levels before January as it will be a much more muted January sale period.

Driving new sales with D2C

And last, but by no means least, Martin was joined by Mona Nikzad from Organix. As the UK’s No. 1 baby finger food and toddler snack provider, Mona explained how developing an e-commerce offering had always been on the roadmap for her business. Traditionally, supplying supermarkets and food outlets has been their main form of revenue, but their plan to go direct-to-consumer (D2C) was accelerated by the pandemic.

Mona explained how setting up an e-commerce channel was something she wished Organix had done sooner, with the business seeing some amazing results post launch – exceeding all their goals and KPIs. She also explained how this strategy has fed into their brand engagement and sentiment online, doing more than just driving sales.

Perhaps the most surprising insight from the Organix story was their ability to launch an e-commerce offering in just 6 weeks with a budget of just £10K. Showing that the ability to tap into this growing trend of online shopping to generate increased revenue doesn’t have to be a time consuming or costly venture. Her advice was to take the plunge; present the business case, test and learn, and fail fast.

Summary

It is clear that digital is going to play a huge role for retail in the coming months, with those adapting their strategies now to capitalise on the opportunities available being the best placed to weather the storm and grow through the recession.

Summit would like to thank all those who attended the event, with special thanks to the guest speakers who all shared some invaluable insights. With an exciting line up for our next event, including a guest speaker from eBay, we urge you to sign up now to find out how you can recession proof your sales plan.

If you’d like more information or wish to speak to one of our team, please email info@summitmedia.com.

Ready for change? Let's talk

Speak to Summit